Banks and Financial Institutions: How to Operate Digital Assets at Scale

The digital asset market is at a crossroads, much like the early internet. Innovators have proven the technology, but broad adoption still depends on trusted institutions. Get an overview of what infrastructure it takes for banks to operate digital assets at institutional scale.

Last updated on Thu Nov 13 2025

The early phase of the internet was a chaotic playground for enthusiasts, startups, and pioneers pushing technological boundaries. They proved the technology worked but faced many challenges: it was fragmented, lacked essential infrastructure, and failed to gain broad institutional trust. The internet’s real breakthrough came when large institutions stepped in. They provided scale, reliability, and resilience, transforming the technology into a global infrastructure for secure payments and thriving commerce.

A similar inflection point is now emerging in the digital asset space. Early adopters have demonstrated strong demand. To make this market truly global, sustainable, and trustworthy, however, the active engagement of financial institutions is essential.

These institutions face significant hurdles: fragmented digital assets markets, incompatible legacy systems, regulatory requirements, and the inherent complexity of institutional setups. Facing these challenges and adopting digital assets as a big player will make cryptocurrencies, tokenized securities, stablecoins and other asset classes accessible to anyone.

Overcoming Institutional Roadblocks to Digital Asset Adoption

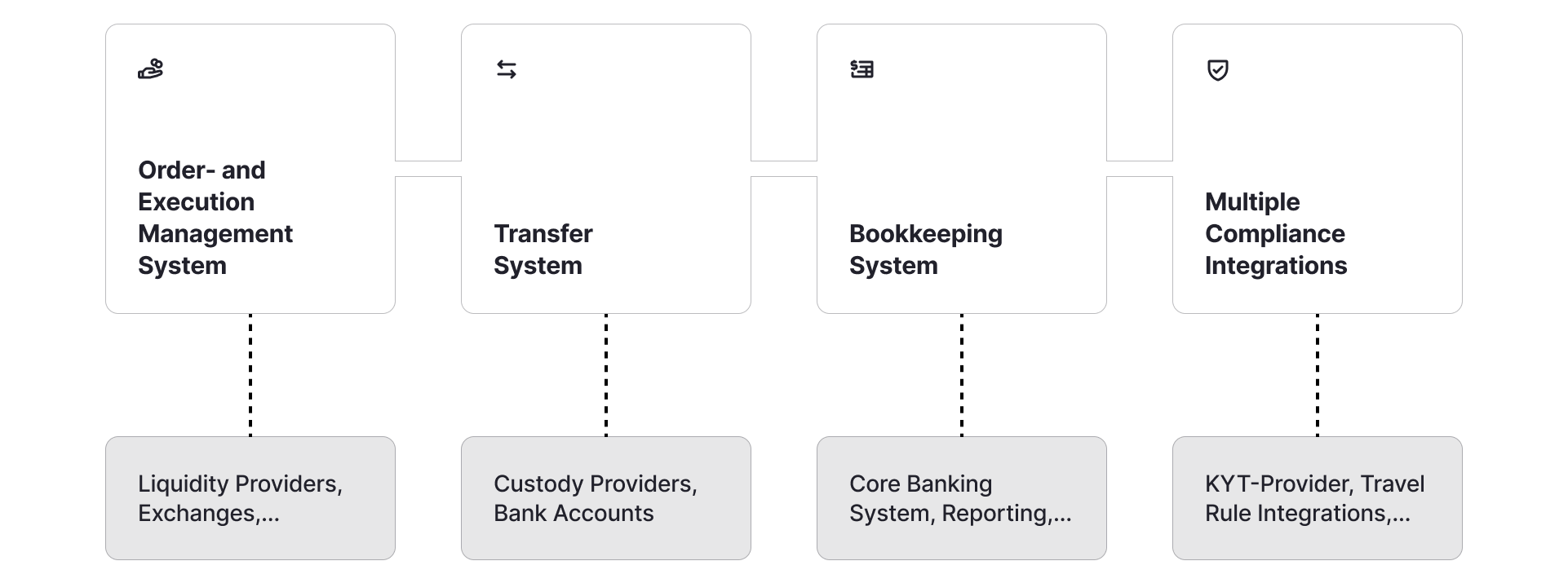

Operating digital assets inherently demand a robust technical infrastructure. The key to institutional-scale operations is leveraging systems that can handle the unique complexity of any digital assets:

- Order and Execution Management System (OEMS): Digital markets operate 24/7, and trading often occurs in tiny fractions. Institutions need a system that can keep pace, ensuring every order is executed smoothly and reliably. Traditional systems typically struggle with these requirements, as they were not designed to handle assets with 18 decimals, like Ethereum, or continuous 24/7 operations.

- Transfer System: In treasury operations, value often needs to move securely across different networks, at speed and always in compliance. Only the right transfer system can initiate, monitor, and automate on-chain transactions. Traditional institutional transfer systems, however, do not support these requirements.

- Bookkeeping System: Every balance, fee, and transaction must be tracked with absolute precision. Clients expect trust in their holdings, and regulators demand complete traceability (e.g., MiCAR record-keeping). Reconciliation down to the very last decimal is essential to maintaining credibility.

- Multiple Compliance Integrations: Compliance is no longer just about KYC (Know Your Customer). Requirements such as KYT (Know Your Transaction), the Travel Rule, Trade Surveillance, Best Execution, and Market Conformity Checks are now integral. Each rule represents a piece of the puzzle. Together, they create a significant layer of complexity.

Each system is an essential component, however, only if they are fully interconnected, institutions can operate digital assets efficiently, securely, and at scale:

- The Order and Execution Management System needs connectivity to all Liquidity Providers and Exchanges to enable Best Execution.

- The Transfer System must link with Custody Solutions and Bank Accounts for Fiat withdrawals to streamline transfers and automate settlements.

- The Bookkeeping System requires synchronization with the Legacy Core Banking System and Reporting Systems.

- The Compliance System needs to exchange information with the KYT Provider, Travel Rule Solution, etc.

Digital Asset Banking Infrastructure: The Key to Trust and Global Scale

It’s the infrastructure that makes the new technology usable. Back then it was servers, browsers, and operating systems. In the future, every tradable asset, from securities and bonds to stablecoins and real-world assets, will be on the blockchain.

Every institution needs to be prepared with a system to interact and operate with these digital assets - to make this market truly sustainable and trustworthy.

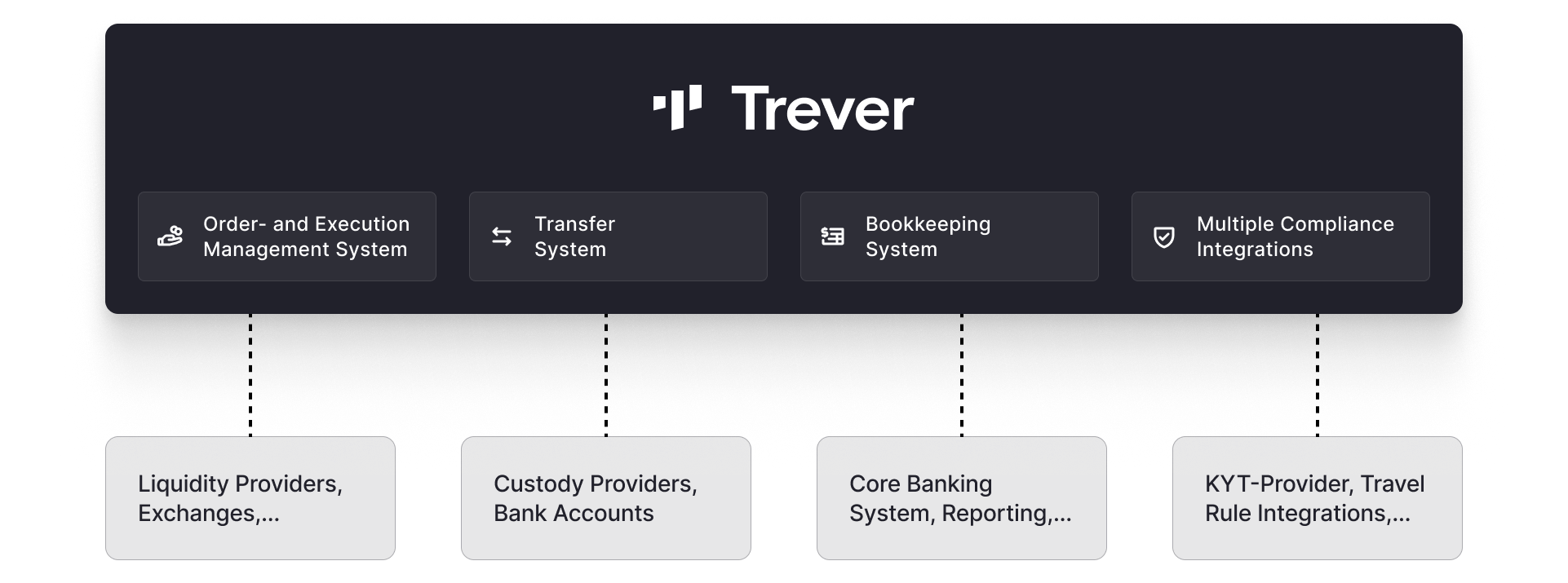

That’s where Trever’s Digital Asset Operating System comes in. Instead of a patchwork of tools, the single, integrated system is able to manage the entire lifecycle of digital assets:

- Modular — start with basic functionality, expand as requirements grow.

- Automated — reduce manual work and operational risk.

- Interconnected — bridge new digital asset workflows with legacy systems.

- Scalable — from trading and custody to staking and beyond.

The Digital Asset Operating System is the foundation that empowers banks to to innovate, and to lead with confidence. For more information, contact our experts via contact@trever.io.

- Check our latest news articles

- Follow us on LinkedIn