Streamline your Digital Asset Operations with This Game-Changer

Connecting to the digital asset ecosystem can be incredibly complex and inefficient, requiring an infrastructure that meets the needs of financial institutions. But how easy would it be managing all digital asset operations in a single suite?

Last updated on Tue Dec 03 2024

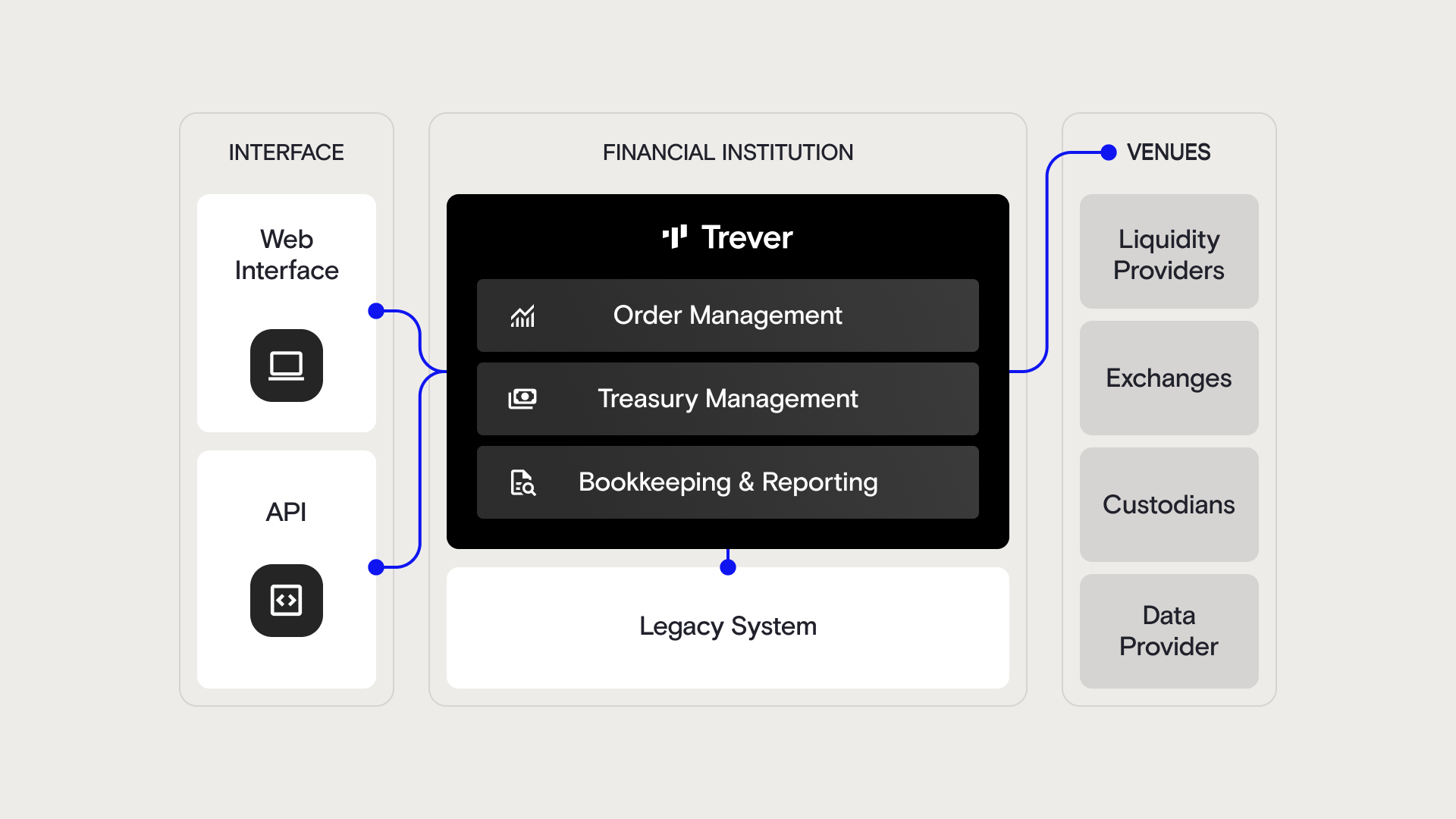

Trever's Operating System is an institutional software suite that unifies the entire digital asset lifecycle in one place. Financial institutions can leverage up to three core modules to significantly streamline the management of digital assets:

Order Management

Place orders through different order types like market, limit, or stop orders and execute them at the best price.

- Price Quotation and Streaming: Stay ahead with accurate and instant price quotes. The fee-aware price quotation system pulls data from multiple sources in real-time and provides prices and quotes including markup and risk based on predefined settings.

- Order Placement and Best Price Execution: Easily place, execute, and monitor orders across multiple venues. By analyzing real-time market data and smart order routing across multiple venues, get the best possible price for every trade to optimize the returns.

- Trade and Post-Trade Data: Access comprehensive information on each trade, including detailed transaction data, parties involved, and associated costs. Post-trade insights also cover essential reporting details like fees, execution time, and trading venue, ensuring transparency and accuracy for compliance and operational reporting.

Treasury Management

Manage risk, liquidity and transfer assets between wallets and venues or schedule transaction jobs.

- Allowlisting (Whitelisting) and transfers: Withdraw assets with enhanced security. Specify approved transaction pathways and destinations, ensuring that assets are only transferred through pre-defined, trusted routes between all connected venues.

- Post Trade Settlement and reconciliation with trading venues: Increase the efficiency of automated post-trade settlement, ensuring data precision through seamless reconciliation with trading venues via Trever's robust reconciliation feature.

- Liquidity and Risk Management: Benefit from the flexibility to choose between manual and automated liquidity management. Manage risk and streamline recurring operations with automatic transfer jobs.

Bookkeeping and Reporting

Stay on top of all balances. Keep book of all transactions and executions by assigning the trades to the customers.

- Bookkeeping/Accounting on Account Level: Automatically capture and record every transaction, ensuring that all booking data is consistently categorized, tracked, and stored without discrepancies. This allows the integration of booking data into existing legacy systems.

- Account Management: It allows to monitor and manage individual account balances, transaction histories, and other essential details. Additionally, the system differentiates between the trade amount and associated revenues or fees, ensuring that the trading fee is automatically allocated to the institution.

- Reporting and Export Data: Detailed, customizable reports on past financial activities provide a clear snapshot of the institution's performance, trends, and areas of improvement. Further, whether integrating with other systems or conducting in-depth analysis, easily export data through the API or download it in a CSV format.

These core modules form the foundation of the operating system. All it takes is a single technical integration to access all digital asset functionalities and further, multiple venues.

Connecting to all required venues

The operating system stands out not only for its time and cost efficient processes but also for its seamless integration with multiple venues, eliminating the need for individual connections. Trever provides comprehensive access to all required venues, which may include:

- Exchanges

- Liquidity Providers

- Custody Providers

- Data Providers

- Crypto Registrars

- etc.

To sum up

The Holistic Operating System is the ideal solution for financial institutions looking to manage digital assets operations time and cost efficiently. All operations are managed in a single platform plus, institutions are able to access 30+ venues through Trever. This tailored, ready-to-use product provides financial institutions with everything they ever aimed for. Digital Asset Operations have never been that fast, flexible and secure before: https://trever.io/contact/

Disclaimer: The information provided on this website and in blog posts is for general informational purposes only. It does not constitute legal or financial advice and should not be interpreted as such. In particular, this information does not constitute an offer or solicitation to buy, sell, or trade any assets or digital currencies.

Please note that Trever GmbH is neither licensed under the Austrian Securities Supervision Act (Wertpapieraufsichtsgesetz 2018, WAG 2018) or the German Commercial Securities Authorization Act (Gewerbliches Wertpapierberechtigungsgesetz, GWB), nor a licensed credit institution. Trever is not registered as a financial service provider and do not offer investment advice or similar services. The views expressed in the content are solely those of the author and are subject to change without notice.

Trever GmbH assumes no liability for any decisions made based on the information provided. The use of this content is at your own risk. We recommend that you seek advice from qualified professionals and conduct your own independent evaluation of the legal and financial implications before making any investment decisions.

- Check our latest news articles

- Follow us on LinkedIn

- Submit a support ticket

- Any other questions? Get in touch